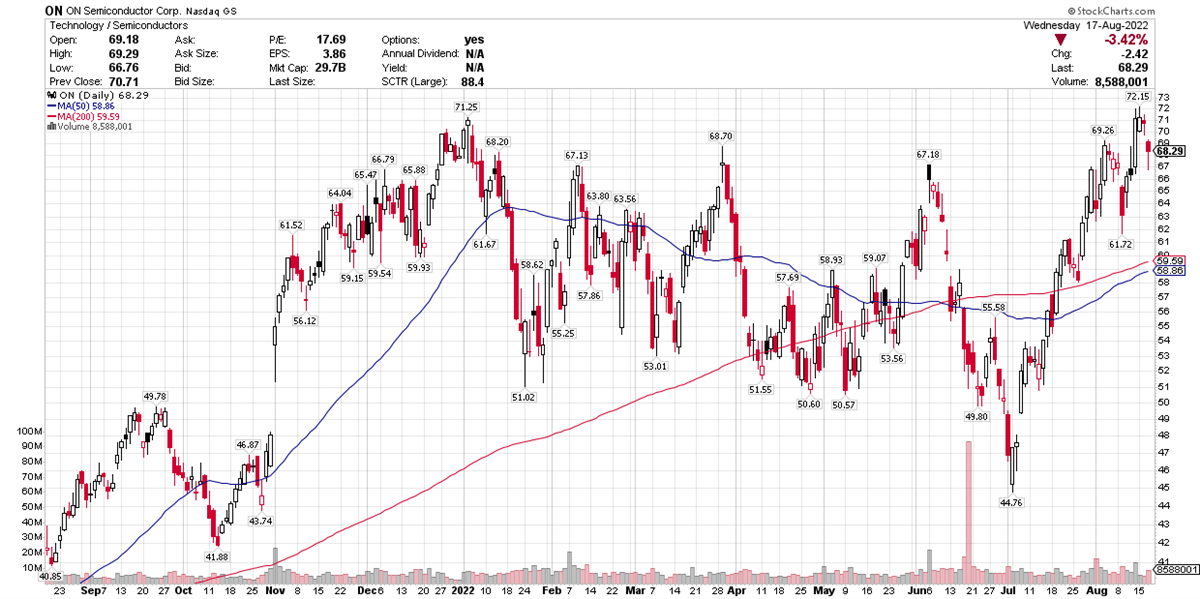

has taken a leadership role within its industry lately, as the stock notched gains of 26.11% in the past month and 28.21% in the past three months.

MarketBeat.com – MarketBeat

Other large-cap chip companies, such as Nvidia (NASDAQ: NVDA) and Advanced Micro Devices (NASDAQ: AMD) have shown fundamental strength lately, but that hasn’t been matched in terms of price appreciation.

ON rallied to a new high of $72.15 Monday, before retreating slightly on Tuesday and pulling back in tandem with the broader market Wednesday.

Year-to-date, ON is up 4.11%. That doesn’t sound like much ordinarily, but in a year where the S&P 500 is down 9.95% and the S&P tech sector is down 13.07%, it’s quite an accomplishment.

It’s also worth comparing ON’s performance to the Philadelphia Semiconductor Index, which is tracked by the Invesco PHLX Semiconductor ETF (NYSEARCA: SOXQ).

There’s definitely some disparity between ON’s gains and broad index performance, although the current trend is up. Recent index returns are as follows:

- 1 month: +13.27%

- 3 months: +4.43%

- Year to date: -22.94%

So what’s behind onsemi’s outperformance, relative to its broader industry?

For starters, the stock has topped analysts’ earnings and revenue views in every quarter since August 2020. In its most recent quarter, onsemi earned $1.34, ahead of consensus estimates for $1.26 per share. Revenue of $2.09 billion also came in ahead of views.

For the full year, ON is expected to earn $5.12 per share, which would be a gain of 74%.

Ready To Pull Back?

With the stock at new highs, following a rally that began in early July, is a retreat in the cards?

Its current price-to-earnings ratio is 16, so not terribly high by growth-stock standards.

MarketBeat analyst data show that Wall Street has a consensus price target of $73.30 on the stock, an upside of 7.33%. Remember: That target could extend out for 12 to 18 months, meaning the stock could pull back before reaching that number.

One thing impressing analysts: The company itself raised its targets for its silicon carbide technology, which is used in electric vehicles, among other applications. More than half of ON’s sales come from the automotive industry and other growing industries. Sure, that gives the company some risk, if there is a cyclical decline throughout its customers’ industries, but it’s also pretty clear the EV market represents healthy future growth.

But not all chip companies are following the same price appreciation trajectory as ON Semi.

Nvidia’s Lowered Forecast

Fellow large-cap chip Nvidia, which specializes in graphics cards for gaming, cryptocurrency mining, and other uses, including automotive, has been correcting since late November. Nvidia’s price peaked around the same time the S&P 500 started to wobble before the broader index finally rolled over in January.

There’s less optimism about Nvidia at the moment, given the company’s own forecasts for 3% year-over-year revenue growth in the quarter ended July 31. That’s down from an earlier forecast, largely due to revenue declines among its customers in the gaming industry.

Wall Street expects Nvidia to earn $4.33 per share for the full year. That earnings target was adjusted lower recently.

As this company is due to report earnings on August 24, it’s wise to use caution if you are considering a buy at this time. Even the slightest negative comment in the report can send a stock sharply lower. That’s true even if a company beats expectations.

AMD Rated “Moderate Buy”

AMD has also been correcting since late last year, although the company’s earnings and outlook remain strong. AMD topped analysts’ views in its most recent quarterly report, and Wall Street adjusted its full-year earnings expectation higher, to $4.35 per share, which would be a 56% year-over-year increase.

AMD’s chief product lines include microprocessors and embedded processors, graphics processors, and semiconductor devices used in servers, personal computers and network systems.

According to MarketBeat analyst data, the consensus rating on the stock is “moderate buy,” with a price target of $125.93, a 28.15% upside.