The Biggest Opportunity in Real Estate Since 2008

Disclosure: Our goal is to feature products and services that we think you’ll find interesting and useful. If you purchase them, Entrepreneur may get a small share of the revenue from the sale from our commerce partners.

Something unusual is happening in commercial real estate. It’s a moment that comes around once every 15 years or so. Prices start to massively reward buyers. And buyers who understand market cycles begin assembling their war chests.

Prologis (NYSE: PLD) scaled their property holdings after 2008, and their stock gained 950% by 2021.

American Tower Corp (NYSE: AMT) did the same, and their stock gained 910% in that time period.

Finally, Crown Castle (NYSE: CCI) gained 1,300% after similar buying activity.

Today, these are some of the largest industrial real estate owners in the world, valued between $40 billion and $120 billion.

Now, the market is aligning again. This time, AARE is letting everyday investors in on the action.

What makes AARE’s opportunity even more interesting is that they’re not yet a public REIT. Like mutual funds for real estate, REITs (real estate investment trusts) allow investors to invest in large-scale property portfolios made up of income-producing real estate that is owned, operated, and/or financed by the trust.

And AARE is stilll at ~$39 million valuation, when their publicly traded peers are valued at more than 100x. A valuation gap this large means AARE investors have a chance at upside in addition to the classic income REIT investment.

A REIT portfolio 20+ years in the making

AARE has spent the last 20+ years building toward the ideal commercial real estate portfolio. With $2.75 billion+ in real estate transactions under their belt, the REIT strategy is straightforward:

- Acquire income-producing commercial properties at discounted prices.

- Build a diversified portfolio positioned for steady, long-term income.

- Distribute up to 100% of taxable income to shareholders.

The company is targeting dividend payments within 24 to 36 months. That’s grounded in real performance, since they’re already generating cash flow and $7 million+ in recurring revenue, the company says.

Plus, up to 75% of their investor capital is directed into hard assets, anchoring AARE in tangible value, the company says. And now that the commercial real estate market favors buyers, AARE is adding even more. For investors, that means sharing in more income-generating residential and commercial properties.

Here’s why now is the moment to join them.

Real estate’s next ‘1,300%’ moment is underway

Between now and 2027, trillions of dollars in commercial loans, including roughly $162 billion in multifamily loans, will come due. Many owners can’t refinance at today’s rates. When debt matures and refinancing isn’t an option, sellers don’t always have a choice.

Image credit: AARE

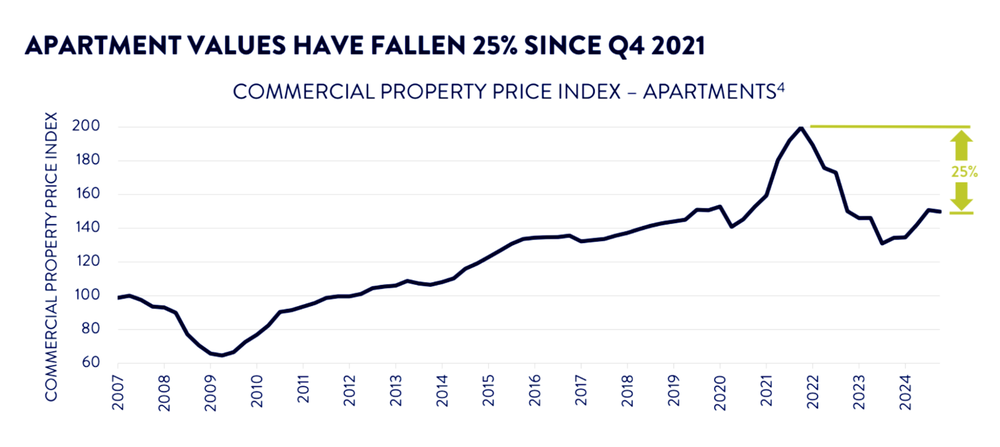

Since late 2021, apartment building values are down roughly 25%. That’s a big shift after a decade of steady growth.

Image credit: AARE

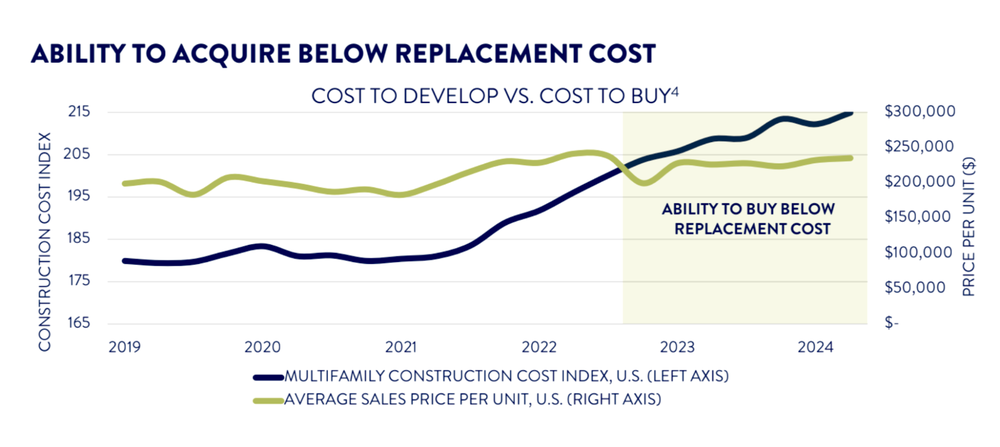

Construction costs have also jumped due to inflation and labor shortages. At the same time, building prices have fallen. This has created a promising scenario for buyers: existing properties now cost less than building new ones. It’s called buying “below replacement cost,” a classic value signal in real estate.

Image credit: AARE

The result: some of the most valuable real estate on the market is changing hands at 30% to 40% discounts.

Lastly, interest rates have reshaped the market over the last few years. From 2022 through 2024, the Federal Reserve raised rates at a historic pace. It increased borrowing costs and put pressure on property values across the commercial real estate market. But the cycle is now turning.

As the Federal Reserve begins lowering rates, financing conditions could slowly improve. This shift has the potential to create a tailwind that can turn disciplined acquisitions into value as the market recovers.

The AARE investment opportunity

While upside and income are never guaranteed, one thing is clear: commercial real estate is getting repriced. AARE has seen this cycle before, and now they’re acting on it.

Including everyday investors is a key part of this mission. They’re building long-term value by sharing access and income more broadly. And their Generous CapitalismTM initiative takes that even further, ensuring a portion of company profits are donated to carefully vetted charities. This way, investors can participate in owning income-generating properties while also having a meaningful impact on the community.

But there’s one more factor that separates AARE from an ordinary REIT. They have an entire services division that can generate revenue alongside the real estate portfolio. It’s also been operating for 20+ years, with the potential to pay special dividends in addition to REIT income.

AARE has already expanded to 25 states and plans to continue to expand to all 50 states as fast as operationally possible with its real estate services arm, the company says.

Historically, opportunities like this in commercial real estate deals were blocked by profit-eating middlemen and fees. AARE is choosing a different path. By opening their portfolio to everyday investors before becoming a public REIT, they’re allowing individuals to participate earlier.

Learn more about becoming an AARE shareholder here.

This is a paid advertisement for AARE Regulation CF offering. Please read the offering circular at https://invest.aare.com/

Investments in private placements, and start-up investments in particular, are long-term, illiquid, speculative and involve a high degree of risk and those investors who cannot afford to lose their entire investment should not invest in start-ups.

Something unusual is happening in commercial real estate. It’s a moment that comes around once every 15 years or so. Prices start to massively reward buyers. And buyers who understand market cycles begin assembling their war chests.

Prologis (NYSE: PLD) scaled their property holdings after 2008, and their stock gained 950% by 2021.

American Tower Corp (NYSE: AMT) did the same, and their stock gained 910% in that time period.