Multi-cloud application network and cybersecurity solutions provider F5 (NASDAQ: FFIV) stock has fallen (-35%) for the year. F5 enables organizations and data centers to defend its networks and applications from hackers and bots. The Company has largely pursued a growth by acquisition strategy to enter into and expand footprints in its operating segments. The Company is benefiting from the robust cloud and internet security tailwinds that are also driving growth for its competitors like Palo Alto Networks (NASDAQ: PANW) and Crowdstrike (NASDAQ: CRWD). The pandemic created the global supply chain disruption causing F5 networks to concentrate on its software business to mitigate the backlog in its hardware business. It bolstered its portfolio with Volterra and Threat Shack acquisitions in 2021 to double its total addressable market (TAM) in the cloud and application security segment. Supply chain disruptions have forced the Company to pivot more towards software and away from hardware. This has enabled its software segment to bring in 40% of its total revenues, up from under 24% pre-pandemic in 2019. It’s also enabled the Company is generate 72% of its revenues from recurring sources. While the supply volume haven’t improved, there hasn’t been any further deterioration since June 2022. This could set-up for a second half improvements as its suppliers expect to grow additional capacity by the end of 2022.

MarketBeat.com – MarketBeat

Legacy Hardware Plagued by Supply Chain Issues

F5 originally sold application network controllers (ADCs) to data centers, internet service providers, and governments. ADCs allow application management of internet traffic between network devices and servers. Two catalysts forced the Company to transition towards growing its software business through a subscription model. First, the migration to cloud based applications has hurt the demand for on premise ADCs. Secondly, the global supply chain disruption has limited the ability to ship systems despite strong demand. The Company saw 38% growth in software sales that drove 4% revenue growth.

Robust Earnings

On July 25, 2022, F5 released its fiscal third-quarter earnings report for the quarter ending June 2022. The Company saw earnings-per-share (EPS) of $2.57, excluding non-recurring items, versus consensus analyst estimates of $2.23, beating by $0.34. Revenues rose 3.5% year-over-year (YoY) to $674.49 million beating analyst estimates for $667.81 million. The Company announced an additional $1 billion stock buyback program added to the remaining 272 million buyback program. F5 Networks CEO Francois Locoh-Donou commented, “Customers depend on F5 to secure and deliver extraordinary digital experiences that drive their businesses and fuel their brands. Demand for security across all customer verticals fueled sales in our third quarter resulting in 4% total revenue growth despite ongoing semiconductor shortages.”

Raise the Roof

F5 raised its guidance for Q4 2023 EPS of $2.45 to $2.57 verse $2.28 consensus analyst estimates. The Company estimates revenues of $680 million to $700 million versus $690.89 million consensus analyst estimates. Security concerns continue to drive most of its customer engagements fueling demand in both software and hardware as customers add and scale applications.

The Wins Continue Onward

F5 continues to get wins and gain market share. A major global retailer choose F5 over an existing bot defense provider after a head-to-head three month proof of concept against its existing solution. Its distributed cloud bot solutions proved to be more efficient and convinced the client to deploy F5 for the protection of their apps and customers. F5 enables enterprises to simplify and secure their operations using both traditional and modern architectures. The launch of its new software-as-a-service (SaaS) platform offering in February of its distributed cloud services that enable the delivery of security, multi-cloud networking, and edge computing solutions is gaining traction. The Company is also seeing service providers scale and secure 4G cores and are beginning to move 5G cores into production. F5 is set to grow from software growth drivers and its distributed cloud services SaaS offerings.

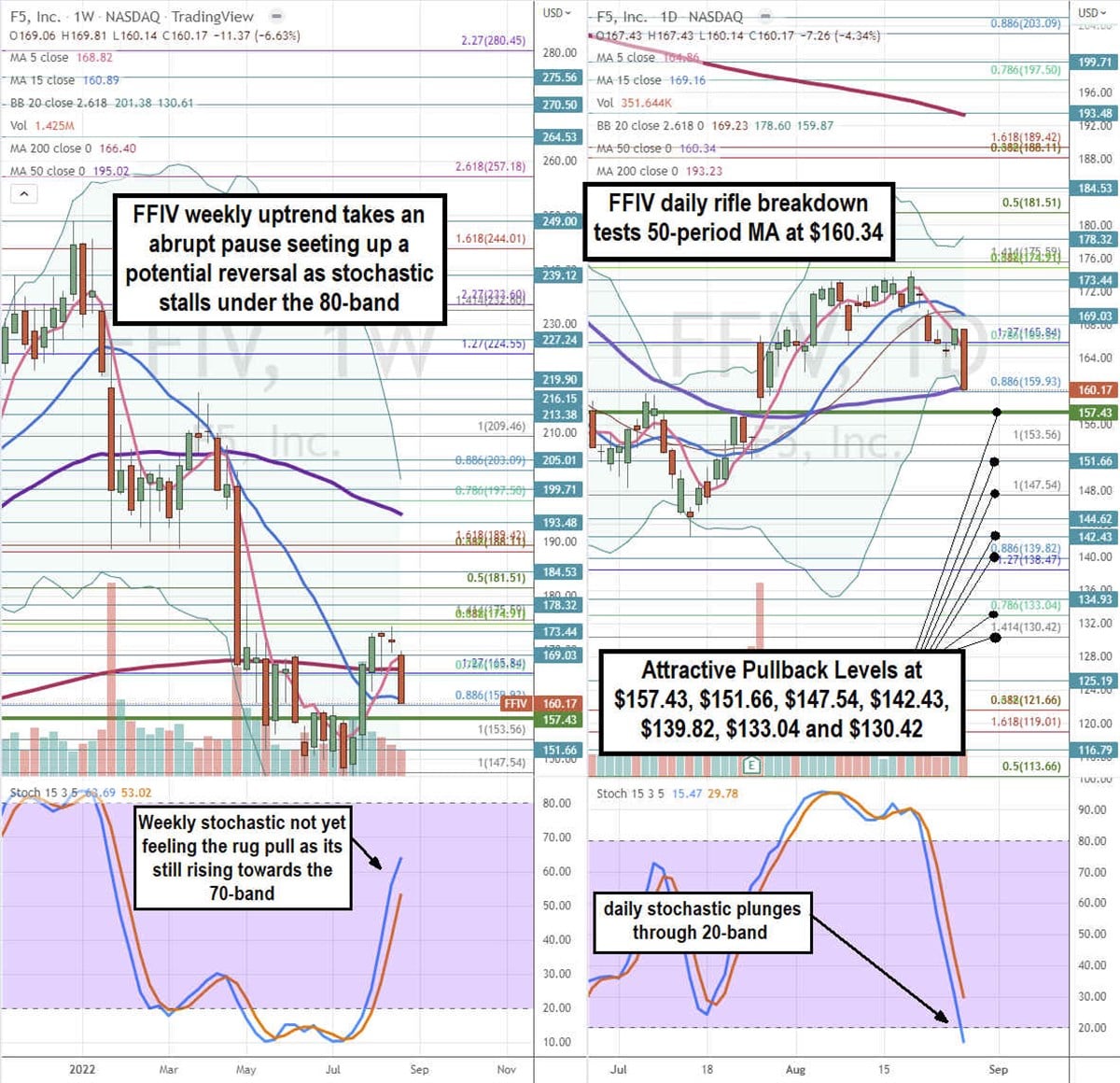

Here’s What the Charts Say

Let’s analyze FFIV on the daily and weekly time frames through the rifle charts. The weekly rifle chart uptrend has a rising 5-period moving average (MA) at $168.82 followed by the 15-period MA support at $160.89. The weekly 200-period support sits at $166.40. The weekly stochastic is rising towards the 70-band. This would normally be a bullish looking chart if not for the aggressive rug pull that caused shares to collapse straight through the weekly 5-period, 15-period, and 200-period MAs in a single candle to attempt to make a bottom near the $159.93 Fibonacci (fib) level. Bulls will need to protect the market structure low (MSL) buy trigger at the $157.43. The indicators especially the weekly stochastic will update as time goes on. The daily rifle chart is in the downtrend that’s testing the 50-period MA support at $160.34. The daily 5-period MA resistance is falling at $164.86 followed by the 15-period MA at $169.16. The daily lower Bollinger Bands (BBs) are testing at $159.87. The daily stochastic has made a full oscillation down through the oversold 20-band. Attractive pullback levels are at the $157.43 weekly MSL trigger, $151.66, $147.54 fib, $142.43, $139.82 fib, $133.04 fib, and the $130.42 fib level.