Key Takeaways

- BlackRock’s Larry Fink warns that Americans are vastly underprepared for retirement.

- In BlackRock’s recent survey, 62% of people reported having less than $150,000 saved in their retirement accounts.

- Survey respondents said they needed about $2.1 million to retire comfortably.

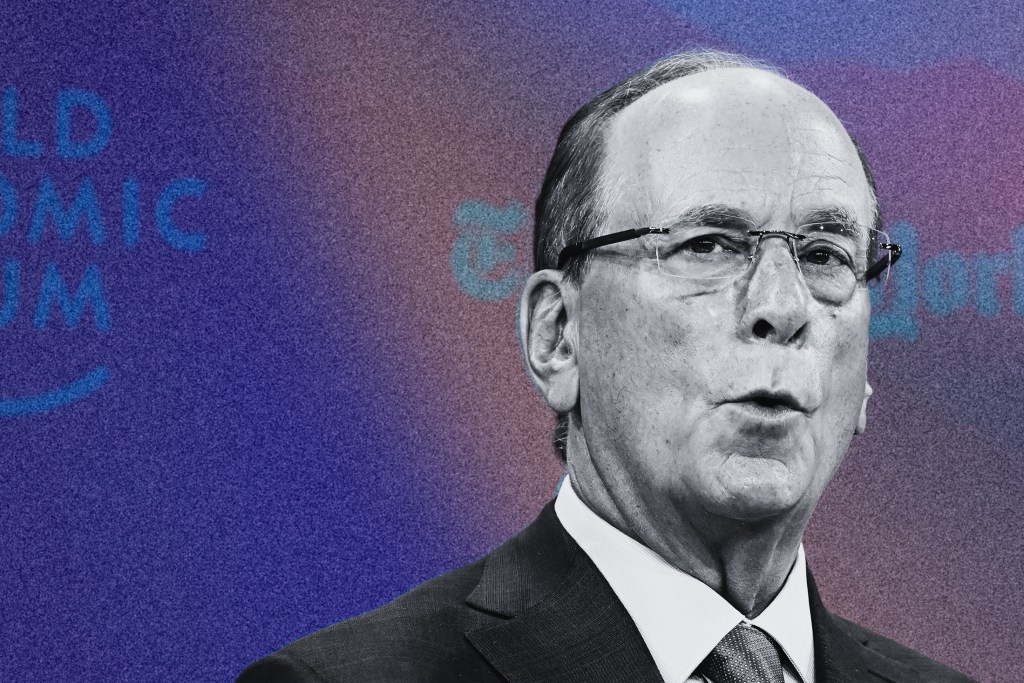

BlackRock CEO Larry Fink says Americans are dramatically underprepared for retirement — and the numbers paint a grim picture.

In his 2025 annual shareholder letter, Fink, 73, told Americans they “haven’t saved enough to retire comfortably.” BlackRock manages about $14 trillion in assets, more than half of which are for retirement. The firm conducted a recent survey of 1,000 registered voters in late January and found that, on average, people think they need around $2.1 million to retire.

However, 62% of those surveyed had less than $150,000 saved for retirement, or about 7% of what they believe they will need. According to Fidelity, the suggested retirement savings target at age 30 is about the amount of your annual salary. By age 40, that number jumps to three times your annual salary, and by age 50, it should be six times your annual salary. So, for example, if you earn $100,000, an on-track target at age 40 is $300,000 in retirement savings. At age 67, someone planning to retire and saving about 15% of their pay should have about ten times their annual salary in their retirement savings account, per Fidelity.

The gap between savings and need in retirement underpins Fink’s stark conclusion: “almost no one is close” to being financially ready to stop working.

Vanguard’s “How America Saves” 2025 report backs up BlackRock’s findings. The Vanguard report found that the average retirement account balance was $148,153 in 2024. Americans predict needing far more to retire comfortably. The 2025 Planning & Progress Study by Northwestern Mutual placed the “magic number” for retirement at $1.26 million.

Reasons that savings fall short

Fink has been sounding the alarm on retirement for years. He argued last year that the U.S. is drifting toward a full-blown retirement crisis, where a large share of older Americans will lack the savings to support themselves.

Fink says several structural forces are behind this savings shortfall. First, Americans are living longer, which stretches every retirement dollar to its breaking point. Second, the cost of senior care can quickly blow up a budget. According to Fortune, an extra $7,000 to $9,000 a year for caregiving can significantly strain someone’s finances.

“When you’re retired, you’re basically living on a fixed income,” Rita Choula, senior director of caregiving with the AARP Public Policy Institute, told Fortune. “If you have not factored in an additional $7,000, $8,000, $9,000 a year for your fixed income, that can have a big impact.”

The 401(k) problem

Fink also critiqued 401(k)s in his letter, stating that they have failed as a mass retirement solution because they shift responsibility from institutions to individuals. Unlike pensions, 401(k)s “don’t come with instructions,” which leaves many people unsure how much to save, how to invest or how to convert a lump sum into sustainable income over decades.

Even diligent savers can end up paralyzed at retirement, afraid to spend their nest egg for fear of running out of money. “They downsize dreams and delay joy,” as Fink put it in his letter.

“Employers need to offer solutions that turn… savings into predictable income,” Fink wrote.

BlackRock serves 35 million retirement investors overall, about a quarter of the U.S. workforce, according to its website.

Sign up for the Entrepreneur Daily newsletter to get the news and resources you need to know today to help you run your business better. Get it in your inbox.

Key Takeaways

- BlackRock’s Larry Fink warns that Americans are vastly underprepared for retirement.

- In BlackRock’s recent survey, 62% of people reported having less than $150,000 saved in their retirement accounts.

- Survey respondents said they needed about $2.1 million to retire comfortably.

BlackRock CEO Larry Fink says Americans are dramatically underprepared for retirement — and the numbers paint a grim picture.

In his 2025 annual shareholder letter, Fink, 73, told Americans they “haven’t saved enough to retire comfortably.” BlackRock manages about $14 trillion in assets, more than half of which are for retirement. The firm conducted a recent survey of 1,000 registered voters in late January and found that, on average, people think they need around $2.1 million to retire.