It has been a nice week for stocks, and if the debt ceiling issue gets resolved without too much hassle, we could see further rallying. It goes without saying, but it’s a lot easier to make money when the S&P 500 (SPY) is going up, even if our portfolio is less correlated than large caps to the broad market. That said we still made additional changes to the portfolio this week to prepare ourselves for what’s ahead. Read on to get my latest take on the current market conditions and where I think it heads next….

(Please enjoy this updated version of my weekly commentary originally published in the POWR Stocks Under $10 newsletter).

As I mentioned above, stocks are looking a lot stronger this week. While the debt-ceiling is the primary issue to investors, the odds are that it will get resolved before any sort of actual default happens.

Once the self-inflicted drama passes us by, the focus will return to inflation, Fed meetings, and other economics news.

The summer tends to slow down in terms of market action. However, this year may be a bit different as the summer FOMC meetings will be closely watched.

As I said last week, I prefer a bigger picture of market conditions rather than looking at day to day moves.

The S&P 500 (SPY) has had a nice week so far, but as you can see in the chart above, we aren’t even 2 standard deviations from the 50-day moving average.

Obviously, this doesn’t mean the rally will continue. However, we also haven’t seen a sharp enough move higher to necessarily expect a bout of profit taking before the weekend.

Economics and earnings news were fairly uneventful this week. Walmart (WMT) posted stronger than expected results, raising profit and revenue guidance for the year.

Retail sales numbers were also solid for the month of April. All in all, the consumer spending picture still looks positive.

With the economy remaining resilient, it’s difficult to say whether the Fed will raise rates at the next meeting (in June).

The market is about 65% sure they won’t raise rates, but that could change pretty quickly based on new economic data.

I don’t think we need another quarter point rate hike, but the Fed generally doesn’t ask for my opinion.

A brush with default (the debt-ceiling stuff) could change the Fed’s mind, but once again, I don’t expect an actual default to occur.

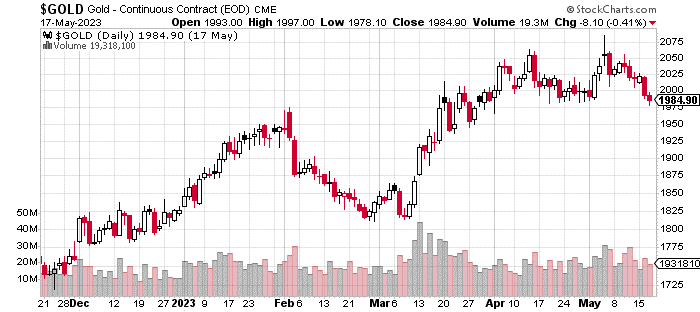

The drop in the price of gold below $2000/ounce, seen above, may be a sign that investors are less concerned about being in safe-haven investments.

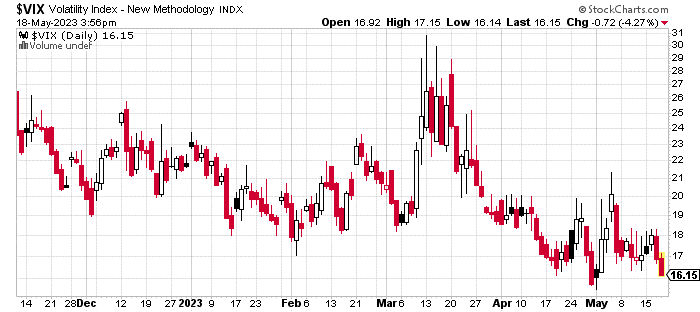

The VIX (the market volatility index) also continues its slow trend downwards. The VIX will have short-term spikes based on one-off news events.

However, its general direction in most years is going to be down or sideways (depending on what kind of year we had previously).

You can see that the VIX is approaching 16. That implies roughly a 1% move per day in stocks. Under 15 is typically considered a low-volatility environment. We may get there this summer, assuming nothing crazy happens with the debt-ceiling or the Fed.

What To Do Next?

If you’d like to see more top stocks under $10, then you should check out our free special report:

What gives these stocks the right stuff to become big winners, even in this challeging stock market?

First, because they are all low priced companies with the most upside potential in today’s volatile markets.

But even more important, is that they are all top Buy rated stocks according to our coveted POWR Ratings system and they excel in key areas of growth, sentiment and momentum.

Click below now to see these 3 exciting stocks which could double or more in the year ahead.

All the Best!

Jay Soloff

Chief Growth Strategist, StockNews

Editor, POWR Stocks Under $10 Newsletter

SPY shares . Year-to-date, SPY has gained 10.04%, versus a % rise in the benchmark S&P 500 index during the same period.

About the Author: Jay Soloff

Jay is the lead Options Portfolio Manager at Investors Alley. He is the editor of Options Floor Trader PRO, an investment advisory bringing you professional options trading strategies. Jay was formerly a professional options market maker on the floor of the CBOE and has been trading options for over two decades.

The post Bulls Back in Charge? appeared first on StockNews.com